Page Vault Browser Web capture software: full-featured and easy to use

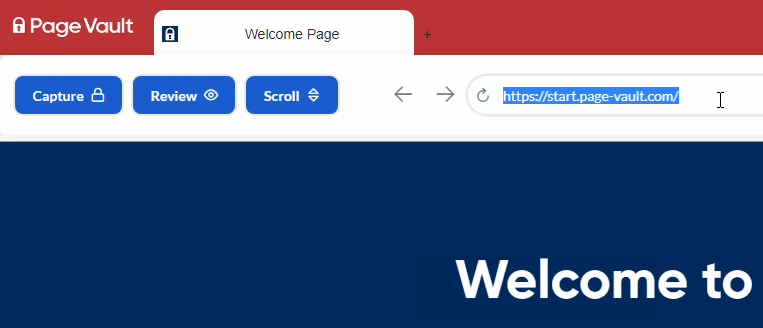

Familiar browser interface, built to make web captures

-

Type in URL

Visit any site on the web, or perform a google search.

-

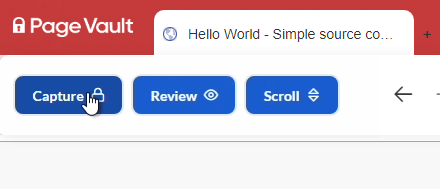

Click capture

Select your settings, then start the capture.

-

The software scrolls and captures the page

You don’t click anything! Sit back and Browser does the work.

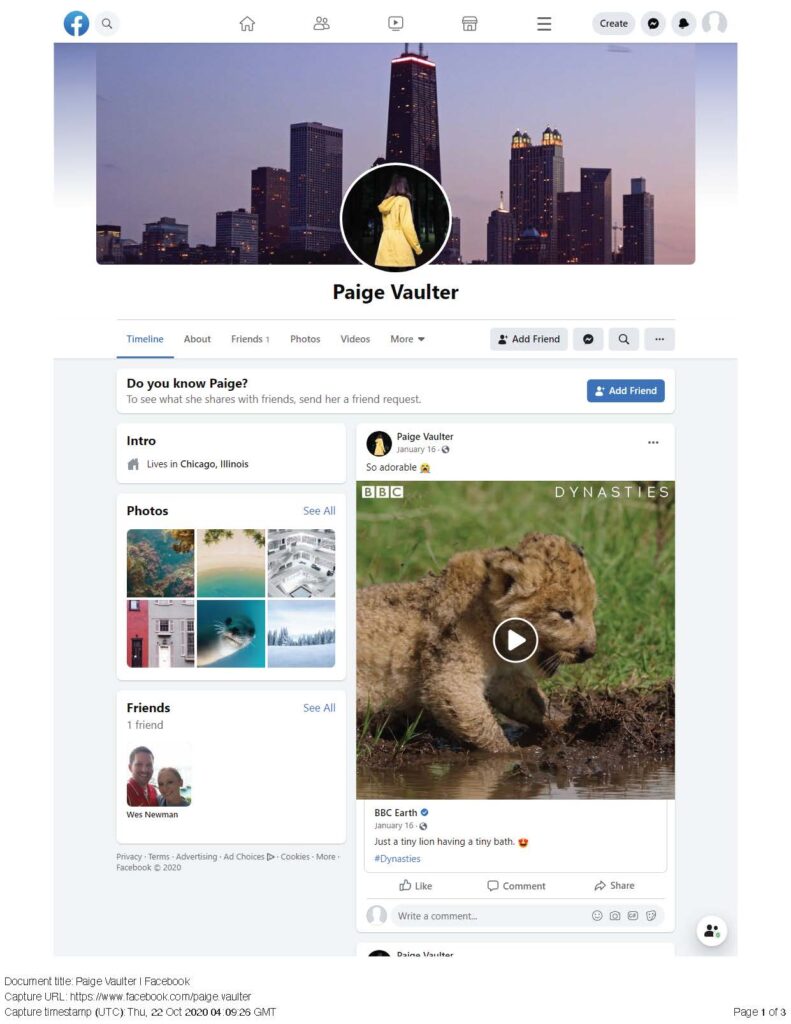

Captures that look great

No missing content, changed formatting, or re-sizing. Just full-page captures that look like they did in your browser.

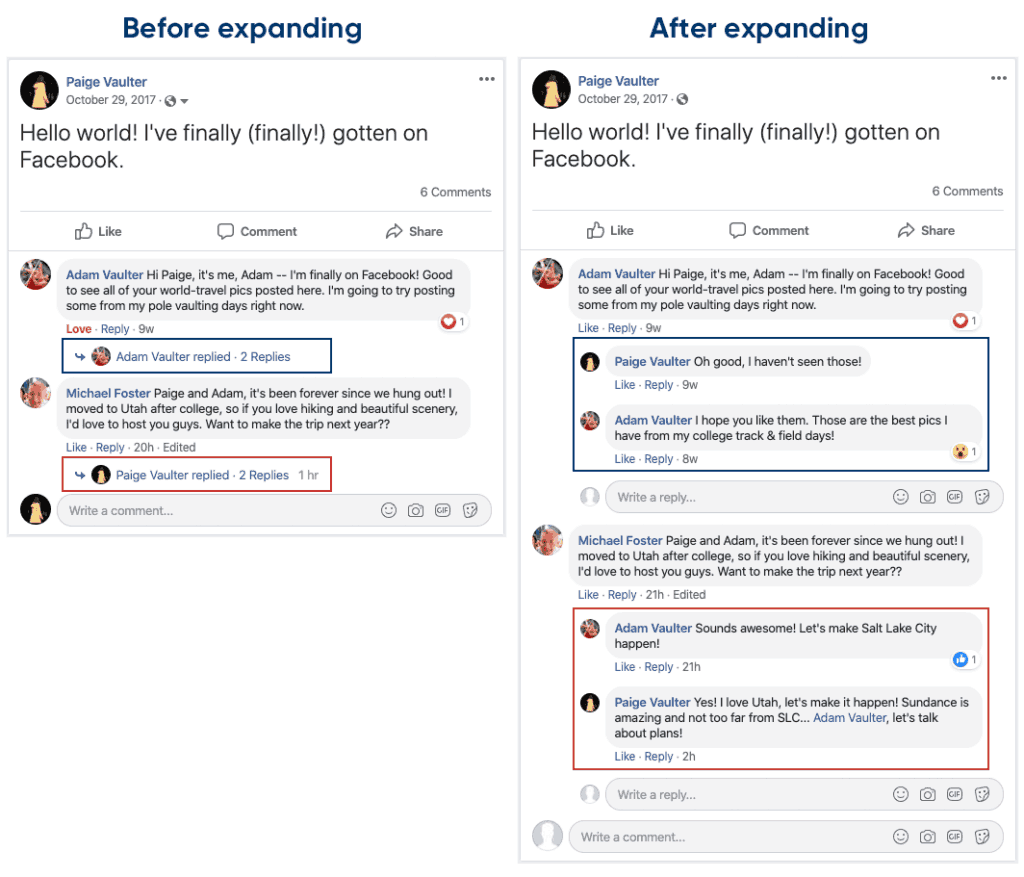

Save hours with automated social media captures

In one click, scroll the entire profile, open comments and replies, and download videos.

Avoid Missing Key Evidence

In just a few clicks, Page Vault can capture an entire website ensuring nothing goes overlooked.

Built for legal professionals.

-

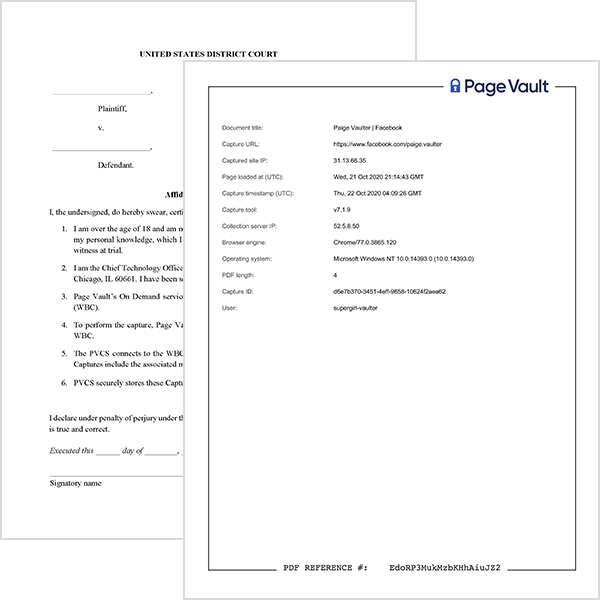

Affidavits

Affidavits are available for all captures made with our Browser software.

-

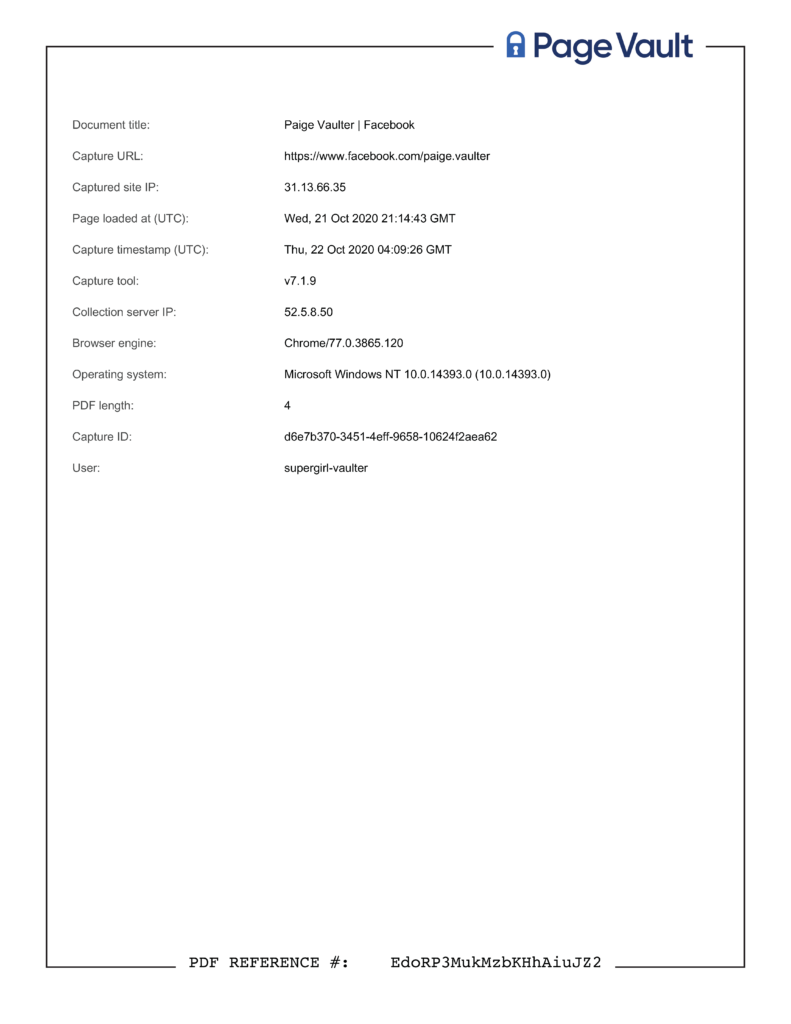

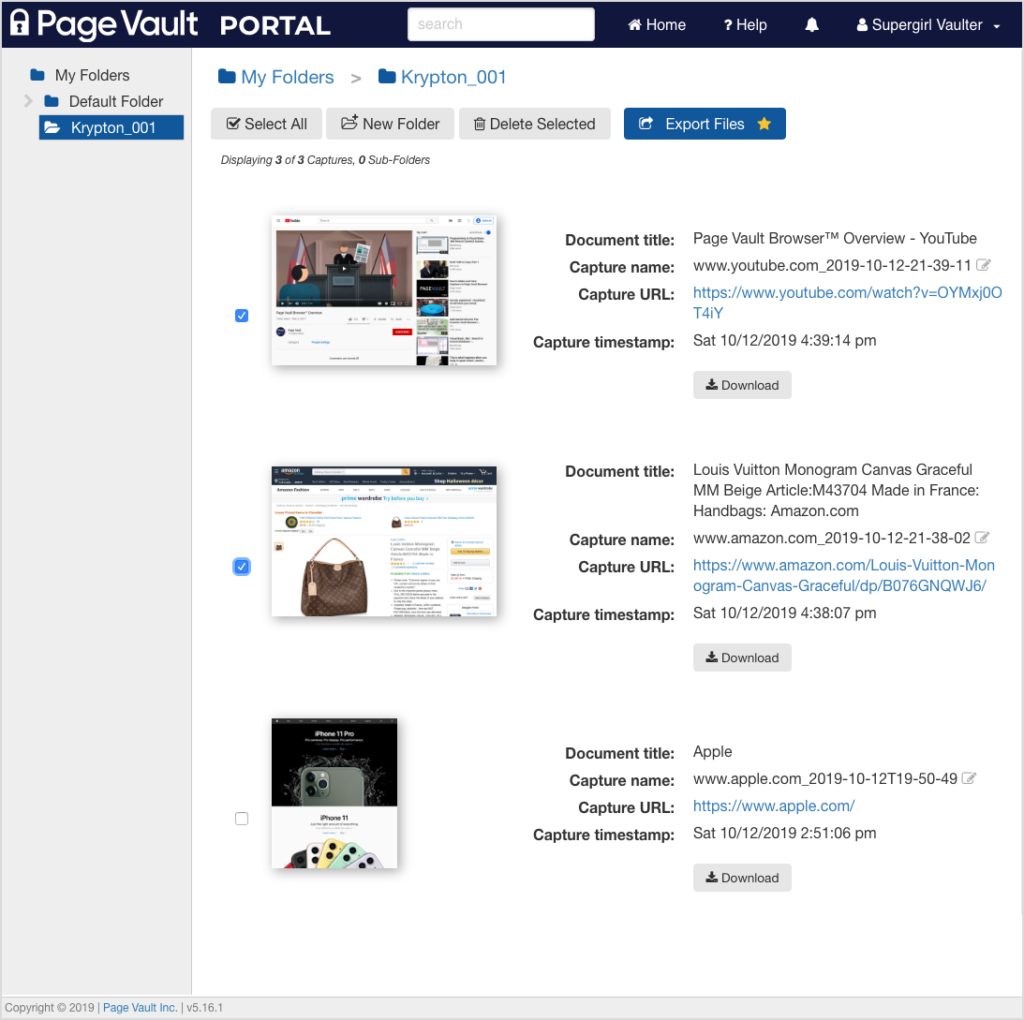

Metadata on every page

Every capture includes timestamp, URL, capturing account, and SHA256 hashing.

-

Maintain the chain of custody

Our patented remote browsing solution keeps you out of the chain of custody and makes your captures admissible.

Sample metadata cover page and affidavit

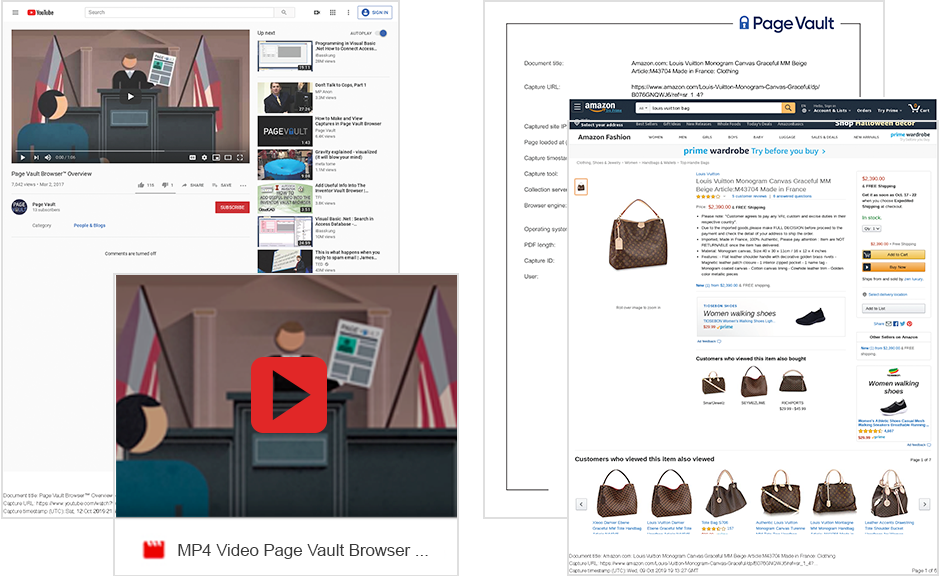

Capture what you see in the browser. Even videos.

-

Web pages of any kind

Web pages, Facebook, news sites, Instagram, TikTok—capture it all.

-

Videos and documents

Download YouTube videos, Facebook videos, PDF files, Excel files, and more.

Unlimited storage and exports. No hidden fees.

-

No storage fees

No limits or extra fees on capture storage—it’s all included.

-

Unlimited downloads and exports

Export as many captures as you want, as many times as you want.

Page Vault Browser Pricing

Annual pricing and contracts.

For higher-limit plans, please contact sales

- Solo

- Team

- Professional

(Most Popular) - Enterprise

-

Usage

- Logins / Usernames

- 1

- 3

- Unlimited

- Unlimited

- Logins / Usernames

-

Extra Features

- Batch

(Videos + Bulk Captures)- $

- $

-

-

- Priority Support

- Affidavits

- $

- $

-

-

- Batch